NEW CAR PRICES

Just how has the COVID-19 pandemic impacted new car prices in Australia?

18 May 2022

HAVE CAR PRICES GONE UP?

You’re not imagining things, both new and used vehicle prices have indeed spiked over the past two years.

And there’s no one particular reason for the increase. In fact, there are several, and they’re all pandemic-related.

Reasons for car price hikes include:

Supply issues stemming from a semiconductor shortage

Increases in cost for raw materials

Complications around shipping and parts procurement

Factory shutdowns

A detailed analysis of 1100 models by goauto.com.au meanwhile calculates that as of March 2022, the average price of a new car is up 7.6% since pre-pandemic times.

It appears, because of the wait times for new cars (due to supply constraints), used car prices have gone up even more.

According to Datium Insight’s price index, used cars have risen by up to 50%.

So, how are people purchasing cars at this rate?

Well, there’s a high chance they took out finance to purchase it, with research showing 52% of car buyers took out a loan to buy a vehicle in the past decade.

In addition to used car values going through the roof since the beginning of the COVID-19 pandemic, new car prices in Australia have risen significantly, adding further pain to the growing cost of personal transportation on the back of recent fuel price increases.

As of March 2022, the average price of a new car is up 7.6 per cent since pre-pandemic times, with some manufacturers’ average list prices rising as much as 17.0 per cent and certain models have gone up by as much as 40.3 per cent.

Based on figures reported & published by GoAuto the pricing of every new passenger and light commercial vehicle sold on the Australian market over the past 30 months and discovered that almost every new vehicle on sale in Australia has risen in price considerably since the pandemic took effect.

Of course, some models have undergone life-cycle updates and others have been replaced entirely. Many variants have fallen away, and new ones have taken their place. But when viewing like-for-like, it’s evident that the price of a new vehicle has increased significantly since before the pandemic.

It could be argued that cars have more technology on board nowadays and are therefore dearer to build and import, while complications around shipping and parts procurement, factory shutdowns and other pandemic-related issues have increased the cost of doing business for car-makers.

But it is worth noting that cars are now dearer when viewed against average wages than at any time during the past three decades and new car pricing has rapidly outrun Australia’s GDP.

Against this backdrop, it looks increasingly likely that price parity between battery electric vehicles (BEV) and those with internal combustion engines (ICE) will be caused by the cost of ICE vehicles going up rather than that of BEVs coming down.

Crunching the numbers

GoAuto has examined the pricing of 1100 models available for sale between August 2019 and March 2022. Those models that have been discontinued since August 2019 or that do not directly relate to a variant sold today have been omitted from the data.

Only three manufacturers maintained their pre-pandemic price levels (Alpina, Ferrari and McLaren), the same number decreasing prices overall since August of 2019 (Bentley, Porsche and Tesla).

Honda and Mercedes-Benz Cars could have not been compared like-for-like owing to their respective agency model moves.

Otherwise, every manufacturer has increased prices by between 0.99 and 17.0 per cent, with a noticeable split between premium and mainstream importers.

Among the premium marques that raised prices, all remained below the 10 per cent threshold and five brands increased them by less than five per cent. In order from the largest to smallest increase ranks as follows:

BMW Australia told GoAuto the company, which upped average prices by 8.42 per cent, reviews its pricing structure throughout the year, taking into consideration a number of factors including the exchange rate, changes to material costs and additional features equipped to its vehicles.

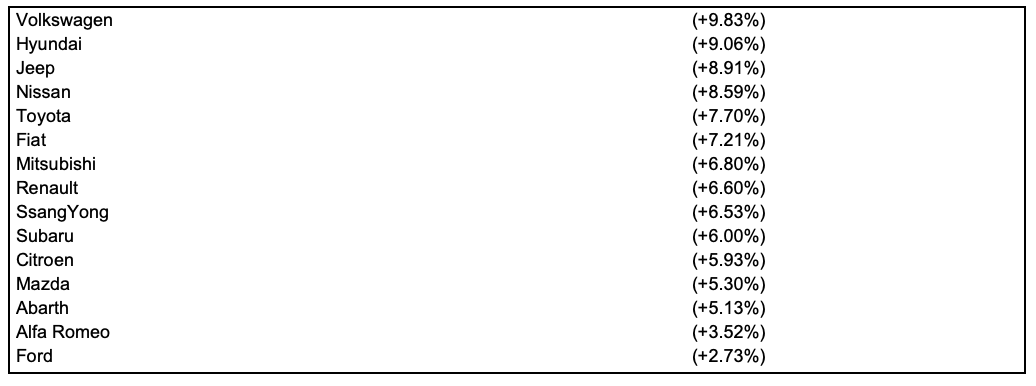

For mainstream marques, there is an almost even split above and below the 10 per cent threshold. Volkswagen and Hyundai scraped in under the 10 per cent mark by the narrowest of margins, while Ford levied an average three-year price increase of just 2.73 per cent.

The recent Hyundai vehicle pricing increases can be attributed to a raise in transport and manufacturing costs Hyundai Motor Company Australia (HMCA) has reported.

Mitsubishi Motors Australia told GoAuto the brand, which increased prices by 6.8 per cent on average. It has however, a unique ‘Diamond Advantage’ 10-year warranty and capped- price servicing program.

Despite the protracted supply chain pressures – both in terms of COVID impact and semiconductor - related parts shortages, which have slightly increased costs of certain model grades – Mitsubishi continues to focus on delivering value and minimising wait times for its customers.

All remaining mainstream brands posted price rises of 10 per cent or more.

The biggest percentage increases came from newcomer Chinese brands including Haval, Great Wall, LDV and MG. Price rises from Mercedes-Benz Vans were similarly high (at 15.20 per cent) alongside locally converted Ram utes (15.48%) and French brand Peugeot (15.13 per cent).

Putting a dollar value on it

In percentage terms, price rises may not mean a lot to many. But when a dollar figure is applied, the recent increase in new car prices takes on another meaning entirely.

On average, most manufacturers managed to restrain price increases to less than $10,000 across their respective portfolios, and one, Volvo, to below $300.

But others have shot above the $10,000 mark, including Ram ($18,888), Land Rover ($11,055), and many more slotting in between rises of $5,000 and $10,000.

Of course, as mentioned at the outset, some model ranges listed below are all new. Increases in pricing between model generations is not uncommon, and often factor in newly introduced technologies, higher exchange rates, and increased material, labour and shipping costs, which can inflate pricing significantly between model generations.

All remaining manufacturers fell below the $5,000 mark, with Nissan running closest to the wire at $4,911. Volkswagen and Haval placed second and third with a fleet average price rise of $4,730 and $4,100 respectively, just ahead of Skoda ($3,964), Kia ($3,941), and Mahindra ($3,917).

Porsche prices fell an average of -$2,919 (or -0.27 per cent) across the range, while Tesla prices contracted by an average of -$8,950 (or -11.56 per cent). Bentley prices fell the furthest overall with a fleet average of -$33,051 (or -2.63 per cent).

Model by model

On a model-by-model basis, the humble Toyota Yaris (excluding GR variants) rose an average of 37.3 per cent or $7,290.

Models facing a price rise of over 20 per cent included those from China, France, Japan, the UK and the Czech Republic with certain Haval, Peugeot, Toyota, Land Rover, Volkswagen and Skoda models jumping significantly.

In the 10.0 to 19.9 per cent range we find:

All remaining models rose between 0.1 and 9.9 per cent.

Brand by brand

Find out how me and my team can assist your business

ring 0410 533 680

or contact me at

carla.r@quantumbusiness.com.au

Disclaimer: The content of this article is general in nature and is presented for informative purposes.